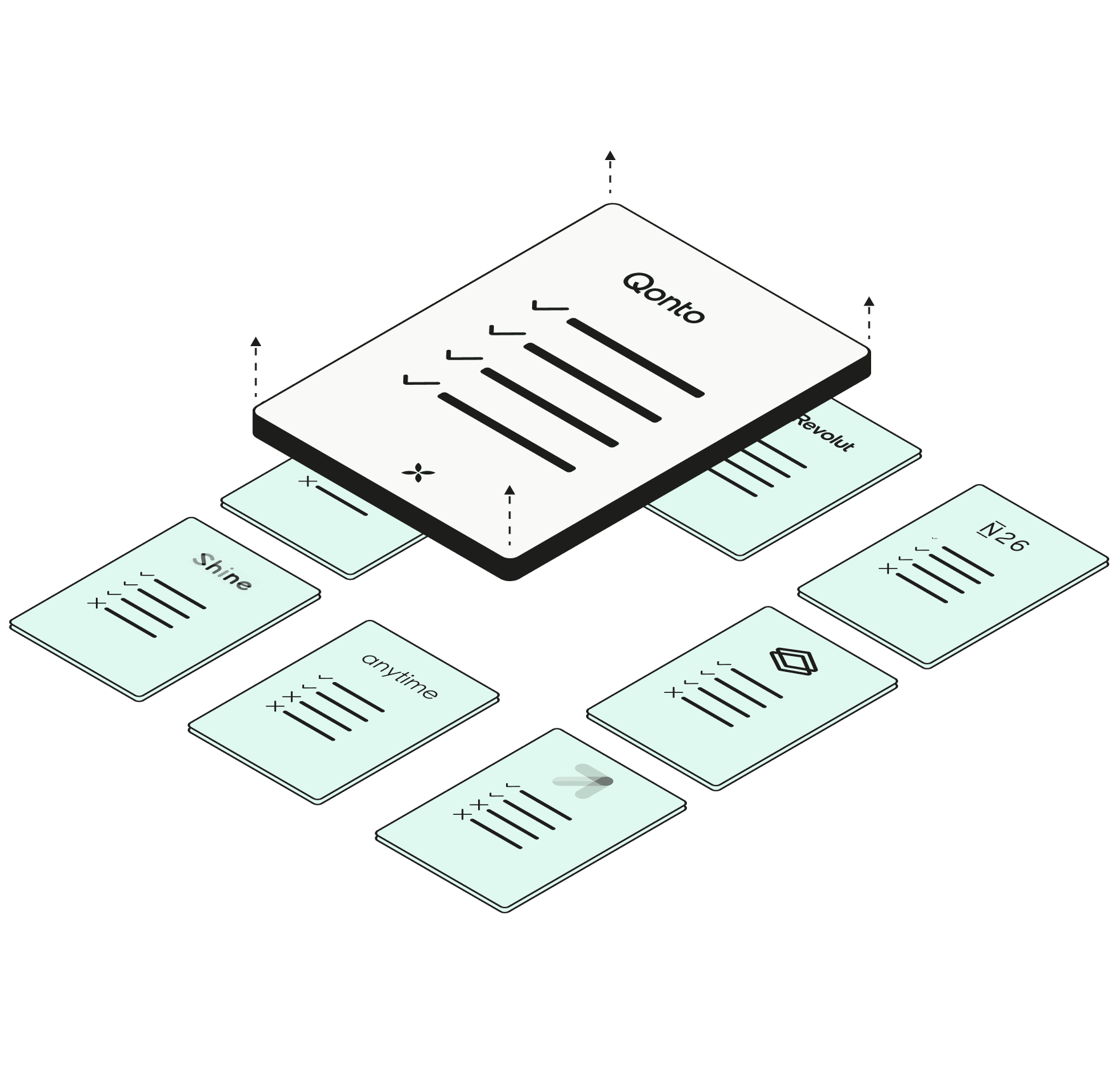

Online business banking comparator

Compare Qonto and other online business banking services.

Comparison made on March 4, 2022.

Take a 30-day free trial

Accounts

Cards

Transfers and direct debits

Checks

Easy accounting

Monthly pricing

From €9

(excl. VAT)

From €9.50

(inc. VAT)

From €9

(inc. VAT)

Capital Deposit

€69 alone

or included in yearly pack

€200

or included in a pack

From €30

(exc. VAT)

IBAN

IBAN depending on market: FR, IT, ES, DE

French or British IBAN

French IBAN

Bank overdraft granted

-

-

Maximum of

€2,500

€2,500

Legal forms

SAS, SASU, SARL, EURL, SC, micro-entreprises, professions libérales, and associations

SAS, SASU, SARL, EURL, SC, micro-entreprises, professions libérales and associations

Micro-entreprises

Help for bank switch

-

-

Cards

Type of card provided

Debit Mastercard card

Debit Mastercard card

Visa Premier card or Visa Classic card

Card transactions in euros

Unlimited

Unlimited

Unlimited

Non-euro card payment

Free

with the X card

€0

per transaction

1.94%

per transaction

ATM withdrawal

Free

with the X card or €1 per withdrawal (with the One Card)

€2

per withdrawal

Free

ATM withdrawal limits

Up to €3,000 per card

per calendar month with the X Card

€5,000

per month

€920

on 7 rolling days

Payment limits

Up to €200,000 per card

per calendar month with the X Card

€30,000 per month

with a limit 5,000€ per day

€3,000

per calendar month

Google Pay / Apple Pay

-

Card reader

1.75% on transaction amount

+ €19 for card reader (to pay once) with Zettle

1.50% on transaction amount

+ €19 for card reader (to pay once)

1.75% on transaction amount

+ €19 for card reader (to pay once) with Zettle

Virtual card

-

-

Disposable card

-

-

Transfers and direct debits

In/out SEPA transfers in euros

Outgoing SEPA transfers in foreign currencies

Between 0.70% and 0.90%

per transfer (18 currencies)

From 0.70%

+ €2.50 per transfer

0.1%

(minimum transfer amount of €20)

Incoming SEPA transfers in foreign currencies

Free

Bank fees

0.1%

(minimum transfer amount of €20)

Debits

SEPA debits

+ B2B SEPA debits included

€2

per SEPA debit mandate

Included

Checks

Checkbook

-

-

Check cashing

Maximum amount per check

No limitation

€6,250

No limitation

Easy accounting

NEW

Receipt certification and archiving

Receipts digitized on Qonto hold the same value as their paper version, thanks to probative value certification. In a simple scan, you are covered in case of control.

-

NEW

Automatic VAT detection

-

NEW

Invoicing

-

-

How does an online banking comparator work?

Online banks and special features

Online banks and accounting services

Online banks and fees

Compare customer services of online banking services for professionals

Ready?

Are you ready to open a business account for your company?

Whether you're a self-employed contractor or a small business with a team,

Qonto can provide the business account you need.

Whether you're a self-employed contractor or a small business with a team,

Qonto can provide the business account you need.