Business banking account comparator

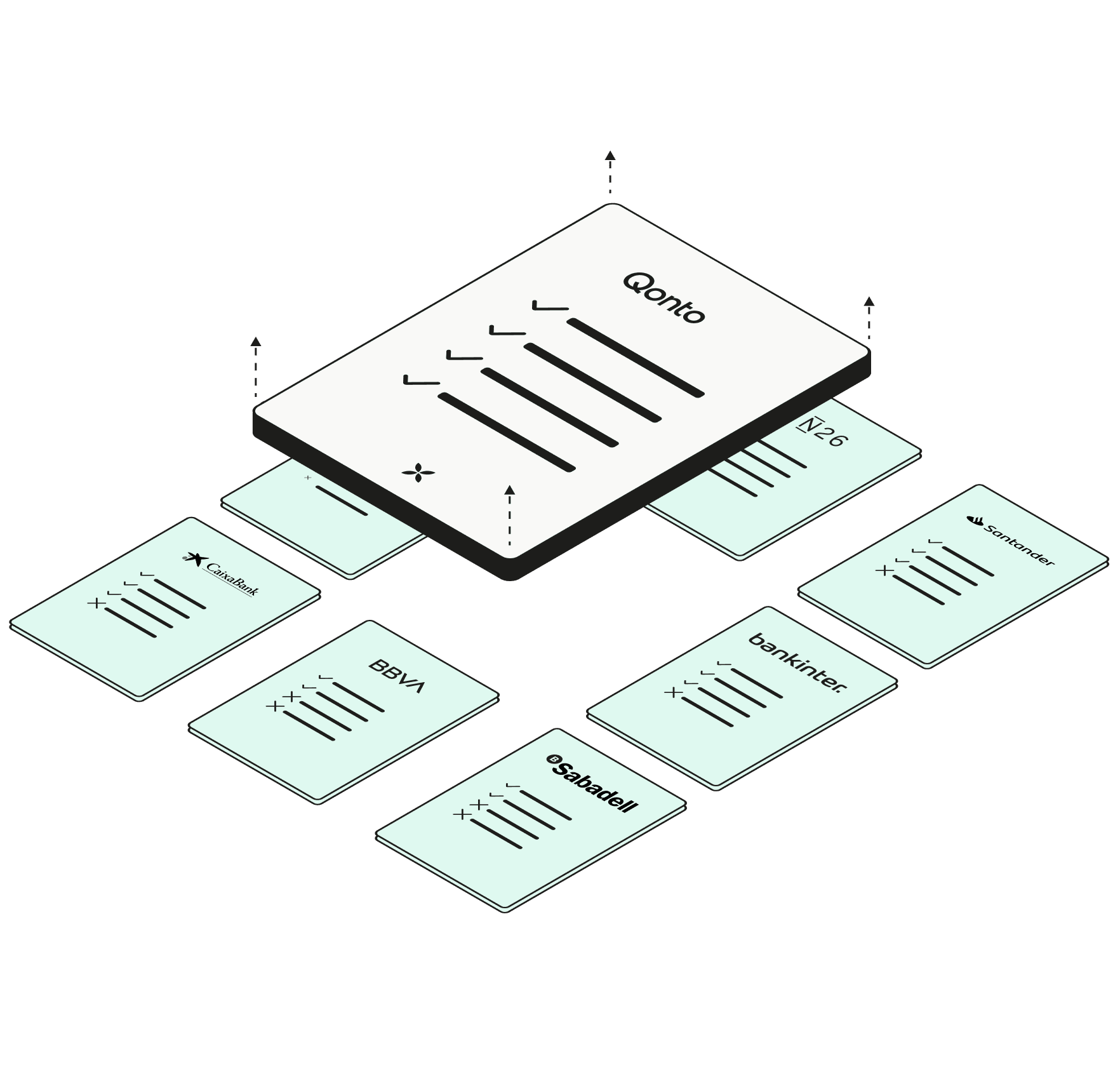

Compare Qonto with other traditional banking services.

Comparison made on April 4, 2022.

Take a 30-day free trial

Main features

Customer service and online banking

Payment methods

Easy accounting

Legal forms

SAS, SASU, SARL, EURL, SC, micro-entreprises, professions libérales

SAS, SASU, SARL, EURL, SC, micro-entreprises, professions libérales and associations

SAS, SASU, SARL, EURL, SC, micro-entreprises, professions libérales and associations

Monthly pricing

From €9

(excl. VAT)

From €19

(excl. VAT)

From €30

(excl. VAT)

Bank fees

Free

Bank fees

Bank fees

Turnover fee

No turnover fee

From 0.06%

per turnover

From 0.06% to 0.20%

per turnover

Bank overdraft granted

-

Help for bank switch

-

-

Customer service and online banking

Customer support

Answering in less than 15 minutes

N/A

N/A

Online banking service

Included

From €150

per year

From €15

per year

Payment methods

Card type

Debit Mastercard card

Visa card or Mastercard

instant debit card

Visa card or Mastercard

instant debit card

Card price

From 1 card included

€57

per year

From €48

per year

Google Pay / Apple Pay

Apple Pay only

-

Check cashing

Maximum of

€10.000

€10.000

per month

Checkbook

-

Free

Free

Virtual Card

-

-

Disposable card

-

-

Easy accounting

NEW

Receipt certification and archiving

Receipts digitized on Qonto hold the same value as their paper version, thanks to probative value certification. In a simple scan, you are covered in case of control.

-

NEW

Automatic VAT detection

-

-

What is the perfect banking service for your SME?

Find the perfect business banking partner with a comparator

Compare customer support

Know your business needs

Estimate the cost of your business account

Ready?

Are you ready to open a business account for your company?

Whether you're a self-employed worker or a small business with a team,

Qonto is the business account that you need.

Whether you're a self-employed worker or a small business with a team,

Qonto is the business account that you need.